Financial Independence for Women: How to Build Freedom and Stability by 2026

There comes a moment in every woman’s life when she realizes — no one is coming to save her. Her peace, her choices, her dreams… all depend on the steps she takes for herself.

For me, that realization changed everything. I understood that true confidence doesn’t come from what we wear or how perfectly we balance everything — it comes from having control over our own lives. That’s where financial independence for women begins. It’s not just about money; it’s about freedom, dignity, and peace of mind.

As women, we often give so much of ourselves — to our families, partners, and work — that we forget to invest in our own growth. But 2026 can be the year everything shifts. The year you decide to start building your own foundation — to create the kind of financial independence for women that allows you to feel safe, fulfilled, and free.

Financial independence as a woman is more than an achievement — it’s a statement. It says, “I can take care of myself. I can create, dream, and build.”

And you don’t have to do it overnight. You just have to start.

So if you’ve been waiting for a sign to begin your journey toward independence, this is it.

2026 is not just another year — it’s your fresh start, your chapter of growth, and your reminder that it’s never too late to design the life you deserve. 🌸

1. Shift Your Mindset: Believe You Deserve More

Before any plan, before saving, and before starting something new, comes the mindset. You can’t truly build financial independence for women without first believing that you deserve it.

For years, I used to think financial stability was something that belonged to “other women” — the ones with better jobs, more confidence, or more time. But the truth is, financial independence for women isn’t something given — it’s something created, step by step, with courage, clarity, and consistency.

As women, we’re often taught to prioritize everyone else first — our kids, our partners, our homes — until there’s nothing left for ourselves. But when you shift your mindset toward financial independence for women, everything changes. You begin to see that taking care of your future doesn’t make you selfish; it makes you strong, wise, and free.

Start by asking yourself:

✨ What kind of life do I want in 2026?

✨ How do I want to feel about money — anxious, or free?

Write it down. Visualize it. Remind yourself that you’re capable of more than just surviving — you’re capable of growth, stability, and abundance.

Because financial independence for women begins the moment you stop doubting your worth. Once your mindset embraces that you deserve more, your actions naturally follow — and that’s when freedom truly begins to take shape. 🌿

2. Start Small: Create Multiple Income Streams in 2026

One of the biggest myths about financial independence for women is that it requires a huge salary or a dramatic career change. The truth is, it starts with small, consistent steps — and a touch of creativity and courage.

In 2026, there are more opportunities than ever for women to build financial independence from home, online, or through the passions that light them up. Whether it’s starting a simple blog, opening an Etsy shop, creating digital products, or becoming an affiliate for brands you genuinely love — every new income stream becomes part of your journey toward financial independence for women.

When I first started, I didn’t have a big plan or much confidence. I only knew I wanted freedom — to support myself, contribute to my family, and feel proud of what I built. Step by step, that dream became my reality.

Think about what comes naturally to you:

✨ Are you creative? Try printable designs or handmade crafts.

✨ Do you love to write? Start a blog or create digital guides.

✨ Are you organized? Offer virtual assistant services.

✨ Have you built experience in your job? Turn it into a freelance skill.

Each of these paths can grow into something meaningful — something that gives you stability, confidence, and purpose.

Because financial independence for women isn’t achieved overnight — it’s built through daily choices, quiet persistence, and a belief that your time and skills have value. The beauty of starting small is that you can grow at your own pace, without fear or pressure. What matters most is that you begin. 🌿

✨ This Budgeting Planner for Women ] is perfect for organizing monthly income, expenses, and goals — it turns finances into something calm and intentional.

3. Invest in Yourself — Knowledge, Skills & Confidence

If there’s one thing that truly builds lasting financial independence for women, it’s self-investment. Money grows when your mindset and your skills grow — and you are your most valuable asset. The more you learn, the more doors open for you, and the more confident you become in shaping your own future.

In 2026, opportunities for women to learn and earn are more abundant than ever. You can take online courses, join mentorship programs, or read books that expand your financial awareness. Even a 30-minute podcast while cooking can plant a seed that transforms your mindset toward financial independence for women.

When I first started investing in myself, I didn’t have much to spend — but I had time, curiosity, and determination. I took free classes, watched tutorials, and practiced until I gained confidence. Each small lesson added up, one skill at a time.

Here’s the truth: financial independence as a woman isn’t only about numbers — it’s about believing in your ability to create value. You don’t need to know everything before you begin; you just need to start learning something that moves you closer to freedom.

Whether it’s mastering a new digital skill, learning how to budget wisely, or understanding how to market your ideas — every new piece of knowledge becomes a brick in your foundation.

Because every woman who invests in herself eventually becomes unstoppable — and that’s the real essence of financial independence for women. 🌸

✨ When I first started learning how to manage my time and skills, I used this Elegant Weekly Goal Planner — it helped me stay consistent and see progress every single week.

Undated Goal Planner, Daily & Weekly Organizer & Productivity Planner with Goal Setting Worksheets, To Do lists Journal, Notes & Ideas Pages, A5 Size (Pink)

*This post contains affiliate links. I may earn a small commission at no extra cost to you.

4. Save, Plan & Grow — Building a Secure Foundation

Once you start earning, the next step toward financial independence for women is learning how to manage and grow what you make. It’s not just about saving money — it’s about creating security, stability, and peace of mind.

When I began saving, I used to think small amounts didn’t matter — but they do. Every bit you set aside is a promise to your future self. Even $5 a day becomes powerful when it’s consistent. What matters most isn’t the number — it’s the habit.

Start simple.

Open a separate savings account just for your goals — your “freedom fund.” Automate a small transfer each month, even if it’s tiny. Over time, that little act of discipline builds confidence and control.

Then, plan ahead. Make a realistic monthly budget that reflects your real life, not an ideal one. Include moments of joy too — coffee with a friend, a new book, something that makes you feel alive. Financial stability shouldn’t mean restriction; it should mean balance.

And as your confidence grows, look for ways to make your money work for you. Learn about investing, even in small amounts — index funds, digital products, or a passion project. These steps slowly turn financial independence as a woman into reality.

Because financial peace isn’t about having “a lot.” It’s about knowing that, no matter what happens, you’re capable, prepared, and free. 🌿

✨ For creating side projects or managing content, I love this Minimalist Laptop Stand — it keeps my desk clutter-free and helps me stay focused and productive.

5. Give Back & Empower — Helping Other Women Rise Too

The most beautiful part of financial independence for women is that it doesn’t end with us — it multiplies. Every time a woman finds her strength, learns a skill, or earns her first income, she lights a spark for others to follow.

I remember the first time another woman asked me, “How did you start?” That question meant everything. It reminded me that growth isn’t just about personal success — it’s about opening doors for others too.

Whether you share what you’ve learned, support another woman’s dream, or simply encourage her not to give up, you’re part of something bigger — a quiet revolution of women who are building lives on their own terms.

Financial independence as a woman is more than numbers in a bank account. It’s freedom — the ability to make choices with confidence, to create stability, and to show your children what strength really looks like.

So, when you reach a new goal, look back and help another woman take her first step. Because together, we grow stronger. Together, we rise. 🌸

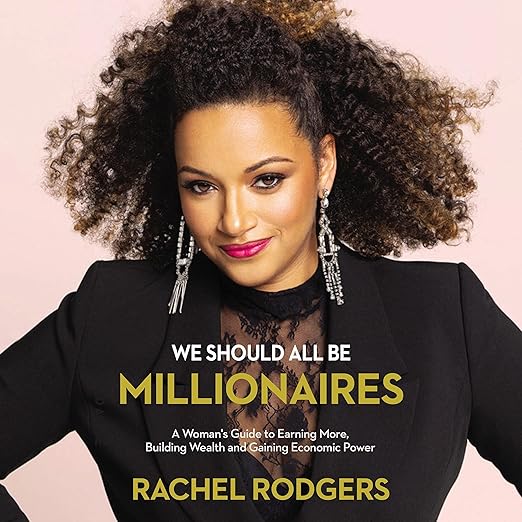

✨ One book that truly changed my mindset on financial independence as a woman is We Should All Be Millionaires by Rachel Rodgers — empowering, realistic, and deeply inspiring.

We Should All Be Millionaires: A Woman’s Guide to Earning More, Building Wealth, and Gaining Economic Powe

*This post contains affiliate links. I may earn a small commission at no extra cost to you.

Closing Thoughts 🌸

As I look back on my own journey, I’ve realized that financial independence for women isn’t about chasing wealth — it’s about creating peace. It’s about knowing that you can stand on your own, make choices from strength, and build a life that reflects your values.

Every small step counts — whether it’s starting a side hustle, budgeting with intention, or simply believing that you are capable of more. The road might feel uncertain at first, but what grows from that courage is freedom — the kind that lets you live, give, and love on your own terms.

If you want to explore more gentle ways to build confidence and structure in your everyday life, you’ll love reading Simple Home Habits That Reduce Stress Daily — a reminder that peace always begins with small, mindful habits.

And if you’d like to dive deeper into the mindset behind success, Forbes Women’s Financial Independence Guide beautifully explains how women around the world are creating sustainable, fulfilling financial freedom.

✨ One thing that helped me stay grounded and focused on my own goals is this Minimalist Weekly Goal Planner — it keeps my dreams visible, my plans organized, and my heart aligned with what truly matters.

Because when women choose themselves — their peace, their purpose, and their potential — everything changes.

The world doesn’t just become richer… it becomes more whole. 🌿

💫 External Links

1️⃣ Forbes Women’s Financial Independence Guide

2️⃣ Investopedia: What Financial Independence Really Means .

👉 https://www.investopedia.com/financial-independence-definition-51803

🌿 Affiliate Disclaimer

This post may contain affiliate links, which means I may earn a small commission if you make a purchase through them — at no extra cost to you. I only share products I truly love and use myself, carefully chosen to reflect the calm, simple, and intentional lifestyle I write about here on The Detangled Nest. Thank you for supporting this space — it helps me continue creating thoughtful, cozy content for you. 🤍